(EXCLUSIVE) Gladys Knight Son’s Chicken & Waffle Restaurant Drama Get’s Worse, Hit With Lien Over Unpaid Taxes

theJasmineBRAND.com exclusively reports, Gladys Knight’s son is in more hot water over his chain of chicken and waffle restaurants in ATL. Recently he was accused of tax evasion and owing over $1 million dollars to the state and now the Georgia Department of Revenue is on the hunt for his property and assets to collect on a $105k tax debt.

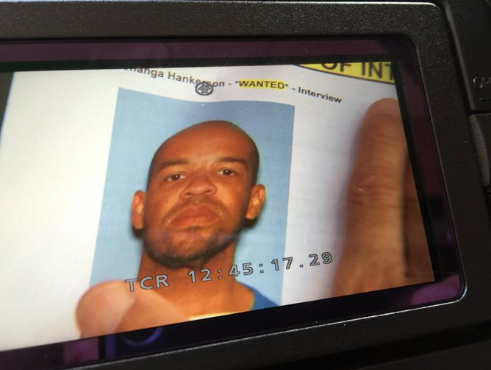

Here’s the latest: On August 22nd, Shanga Hankerson – via his company Rival Group, was hit with a State tax lien by the Department of Revenue over unpaid sales and use tax and withholding tax that he failed to pay related to his ‘Gladys Knight Chicken & Waffles’ restaurant.

They accuse him of owing a total of $105,076.34 for 2011. The original tax amount due was $52k, but with interest and penalties it doubled. The Department explains if he doesn’t pay up on the debt they will seize more of his property and assets to collect on the money.

Here’s the backstory: Back in June, the Department of Revenue accused Gladys Knight’s son, Shanga Hankerson, of theft and tax evasion. Federal agents raided 3 “Gladys Knight Chicken and Waffles” locations in Georgia and shut down their operations. The officials allege Shanga of stealing over $650,000 in sales taxes and withholding taxes owed to the state. The total with penalties and interest exceeds $1 million dollars.

Gladys had no role in the business and only allowed her son to use her name. Reportedly there are still 2 locations open in the ATL area.

The singer filed suit against her son and his companies Rival Group, Cascade Foods and Granite Foods following the tax evasion allegations. She claimed to have sent a cease and desist in July but her son has yet to remove her name from the restaurants.

Gladys allowed her son to use her name for over 10 years, but the deal recently expired and she wants nothing to do with the business. She filed suit demanding the judge order her name be removed from all the restaurants ASAP. The case is still pending in federal court.

Follow us: @theJasmineBRAND on Twitter | theJasmineBRAND on Facebook| theJasmineBRAND_ on Instagram

Previous Article

Previous Article Next Article

Next Article (EXCLUSIVE) Tom Cruise’s Bodyguard, Sean Rinngold, Sues Tabloid Over Story Claiming He Was Charged With Rape

(EXCLUSIVE) Tom Cruise’s Bodyguard, Sean Rinngold, Sues Tabloid Over Story Claiming He Was Charged With Rape  August Alsina Reacts To Fans Noticing Weight Gain, Jokes About Being Fat Shamed

August Alsina Reacts To Fans Noticing Weight Gain, Jokes About Being Fat Shamed  Wendy Williams Opens Up About Her Cocaine Addiction

Wendy Williams Opens Up About Her Cocaine Addiction ![[EXCLUSIVE] Nick Cannon Talks White People Loving Him, Morning Sex + Why He Doesn’t Want His Own Network](https://thejasminebrand.com/wp-content/uploads/2014/04/Screen-Shot-2014-04-02-at-12.35.49-AM-620x524.png) [EXCLUSIVE] Nick Cannon Talks White People Loving Him, Morning Sex + Why He Doesn’t Want His Own Network

[EXCLUSIVE] Nick Cannon Talks White People Loving Him, Morning Sex + Why He Doesn’t Want His Own Network ![[VIDEO] Father of Slain Teen Jordan Davis, ‘Visits The Breakfast Club’](https://thejasminebrand.com/wp-content/uploads/2014/02/rondavis-breakfastclub-jordandavis-thejasminebrand-620x356.png) [VIDEO] Father of Slain Teen Jordan Davis, ‘Visits The Breakfast Club’

[VIDEO] Father of Slain Teen Jordan Davis, ‘Visits The Breakfast Club’ ![[Watch] Brandy Upgrades Choreography In ‘Put It Down’ Video feat. Chris Brown](https://thejasminebrand.com/wp-content/uploads/2012/08/Screen-shot-2012-08-14-at-7.51.24-PM-620x388.png) [Watch] Brandy Upgrades Choreography In ‘Put It Down’ Video feat. Chris Brown

[Watch] Brandy Upgrades Choreography In ‘Put It Down’ Video feat. Chris Brown  Nickelodeon To Introduce First Gay Couple

Nickelodeon To Introduce First Gay Couple  (EXCLUSIVE) Phaedra Parks & Apollo Nida Divorce Questioned By Judge, Battle Far From Over

(EXCLUSIVE) Phaedra Parks & Apollo Nida Divorce Questioned By Judge, Battle Far From Over