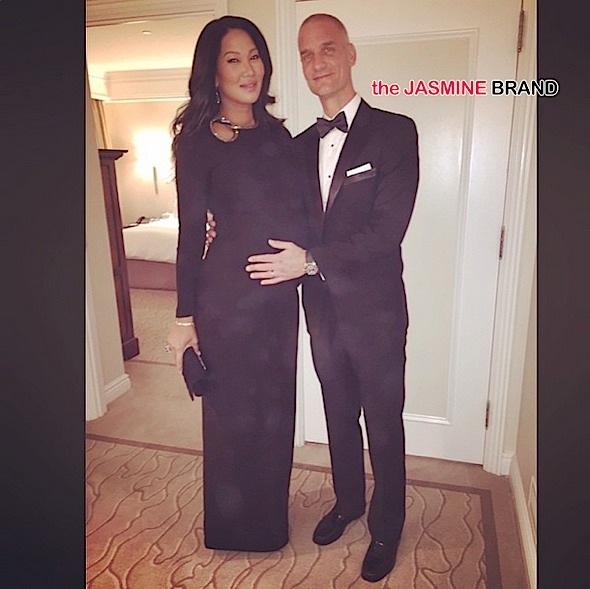

Kimora Lee Simmons Husband Tim Leissner Involved in Money Scandal

Kimora Lee Simmons’ husband, Tim Leissner is involved in an international money scandal, according to the New York Post.

The fallout from the scandal involves the investment bank in which Leissner is the chairman of –the Singapore-based Goldman’s Southeast Asia operations. He now resides in LA with his wife Kimora Lee Simmons and has left that country on a leave of absence from the firm.

A state fund called 1Malaysia Development Berhad (1MDB) was set up with Leissner’s assistance, and Goldman was said to have paid sky-high commissions for bond sales. Then $681 million tied to the fund mysteriously turned up in the bank account of Malaysian Prime Minister Najib Razak. The New York Post reports:

The FBI reportedly is investigating all the fund’s transactions in concert with wider probes of money-laundering allegations spanning five countries.

These probes could force Goldman to face the wrath of a congressional inquiry, according to one legal expert.

Leissner, 45, who is married to Kimora Lee Simmons, the former wife of hip-hop mogul Russell Simmons, lives a jet-setting lifestyle.

Kimora Lee, a businesswoman, designer and former model, last year opened a fashion boutique on tony Beverly Drive in Los Angeles.

She also has important connections. Kimora Lee is reportedly friendly with Razak’s wife, Rosmah Mansor.

Some of the fund’s transactions illustrate the cozy relationship between Goldman and the government.

The sum of three bond sales for 1MDB back in 2012 and 2013, totaling as much as $6.5 billion, reportedly yielded fees, commissions and expenses for Goldman of almost $593 million, the equivalent of 9.1 percent of the money raised. The typical cut for an investment bank is about 5 percent.

“If it exceeds the limit Malaysia sets for investment managers of a fund, then Goldman will have to deal with some negative kickback from Malaysia,” said Dick Bove, a bank industry analyst at Rafferty Capital Markets.

Not that everyone on Wall Street is acting surprised.

“It is a known fact that there is a lot of fraud, and under-the-table stuff like that happens if you are a bank and want to get business done in foreign countries like Malaysia,” said one veteran regulator. Another person who has considered the Goldman case said with a wink that there may have been multiple “managers” feeding off Goldman’s lucrative Malaysian business — in effect, accepting kickbacks.

At the center of the controversy is Leissner, who left the country just as Malaysian officials began ratcheting up the heat on the Malyasian prime minister.

Government officials want more answers on the source of the $681 million. One claim — that the money was gifted by Saudi Arabia for financing the fight against ISIS terrorism — was greeted with some incredulity.

Many people inside and outside Malaysia are not satisfied with the official explanation.

“People are smelling something here,” Gary Swiman, head of compliance and regulatory consulting services at EisnerAmper, told The Post. “This has been a disaster for Goldman.”

Swiman says Leissner could afford to live like a rock star. “He may have been one of the highest-paid people at Goldman,” Swiman added. “And then they pulled him out of Malaysia. This is just the tip of the iceberg. The question is whether this is going to be a congressional inquiry.”

An email to Leissner at Goldman came back with the message: “I am currently out of the office on personal leave with no access to emails.” Calls to his voice mail were not returned.

Leissner, an 18-year Goldman vet with access to the highest reaches of government in Malaysia, likely made millions from Goldman deals he led that later turned controversial, one person told The Post.

1MDB came under intense criticism in the past for borrowing as much as $11 billion to finance dodgy acquisitions. And more than half was said to have come from bond deals underwritten by Goldman.

Follow us: @theJasmineBRAND on Twitter | theJasmineBRAND on Facebook| theJasmineBRANDcom on Instagram

Previous Article

Previous Article Next Article

Next Article![George Floyd’s Memorial Held In Minneapolis – Rev. Al Sharpton Delivers Eulogy: Kevin Hart, Tyrese, Tiffany Haddish, T.I. & Tiny Attend [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2020/05/George-Floyd-thejasminebrand.png) George Floyd’s Memorial Held In Minneapolis – Rev. Al Sharpton Delivers Eulogy: Kevin Hart, Tyrese, Tiffany Haddish, T.I. & Tiny Attend [VIDEO]

George Floyd’s Memorial Held In Minneapolis – Rev. Al Sharpton Delivers Eulogy: Kevin Hart, Tyrese, Tiffany Haddish, T.I. & Tiny Attend [VIDEO]  Wendy Williams To Tyrese: Your wife may need a weave, boob job & Botox one day!

Wendy Williams To Tyrese: Your wife may need a weave, boob job & Botox one day!  Drake Says Kanye Conned Him Into Giving Up Release Date & Revealing He Had A Secret Son, Admits Wanting To Punch Pusha T In His F*cking Face

Drake Says Kanye Conned Him Into Giving Up Release Date & Revealing He Had A Secret Son, Admits Wanting To Punch Pusha T In His F*cking Face ![Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO]](https://thejasminebrand.com/wp-content/uploads/2016/06/taylor-swift-lil-mo-the-jasmine-brand.jpg) Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO]

Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO] ![Katt Williams & Hazel E Attend Rams Game, Floyd Mayweather Celebrates Bad Medina’s Make-Up Line + Kandi Burruss, Taraji P. Henson, Tracee Ellis Ross [Photos]](https://thejasminebrand.com/wp-content/uploads/2016/08/Screen-Shot-2016-08-22-at-7.59.12-PM-620x600.png) Katt Williams & Hazel E Attend Rams Game, Floyd Mayweather Celebrates Bad Medina’s Make-Up Line + Kandi Burruss, Taraji P. Henson, Tracee Ellis Ross [Photos]

Katt Williams & Hazel E Attend Rams Game, Floyd Mayweather Celebrates Bad Medina’s Make-Up Line + Kandi Burruss, Taraji P. Henson, Tracee Ellis Ross [Photos] ![[WATCH] Higher Heels, Longer Weaves & Tighter Leather Tamar Braxton Releases ‘Hot Sugar’ Video](https://thejasminebrand.com/wp-content/uploads/2013/10/Screen-shot-2013-10-18-at-2.25.41-PM-620x356.png) [WATCH] Higher Heels, Longer Weaves & Tighter Leather Tamar Braxton Releases ‘Hot Sugar’ Video

[WATCH] Higher Heels, Longer Weaves & Tighter Leather Tamar Braxton Releases ‘Hot Sugar’ Video  Kylie Jenner Has Cereal For The 1st Time

Kylie Jenner Has Cereal For The 1st Time ![Tika Sumpter Breaks Silence About Pregnancy [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2016/08/Screen-Shot-2016-08-05-at-7.22.05-AM.jpg) Tika Sumpter Breaks Silence About Pregnancy [VIDEO]

Tika Sumpter Breaks Silence About Pregnancy [VIDEO]