Russell Simmons RushCard Fined $13 Million

For RushCard, the CFPB found the company failed to adequately train and staff up customer service lines after the failure and failed to do adequate testing on its end before the conversion happened.

Under the terms of the order, which is in addition to a class-action settlement RushCard reached last year, RushCard customers impacted by the outage will receive awards based upon the damage the outage caused to them. If a deposit was delayed because of the outage, a customer would receive $100, while a customer who had a returned deposit would receive $250, the CFPB said. Customers who experienced a denied transaction will get $25 and customers who received incorrect balance information will get $100. Because of the various ways the RushCard outage impacted its thousands of customers, the amount of damage will vary from customer to customer.

There’s no timeline on when RushCard customers will receive their payments. Current RushCard customers will receive their money in the form of an account credit while former customers will receive a check. Customers do not need to take any action to receive their money, the CFPB said.

As previously reported, RushCard was sold to Green Dot, a major prepaid debit card company, for $147 million. As part of that deal, RushCard agreed to remain liable for any investigations or lawsuits stemming from the failure. Green Dot said it plans to keep the RushCard brand, despite the 2015 technological failure.

Follow us: @theJasmineBRAND on Twitter | theJasmineBRAND on Facebook| theJasmineBRAND_ on Instagram

Previous Article

Previous Article Next Article

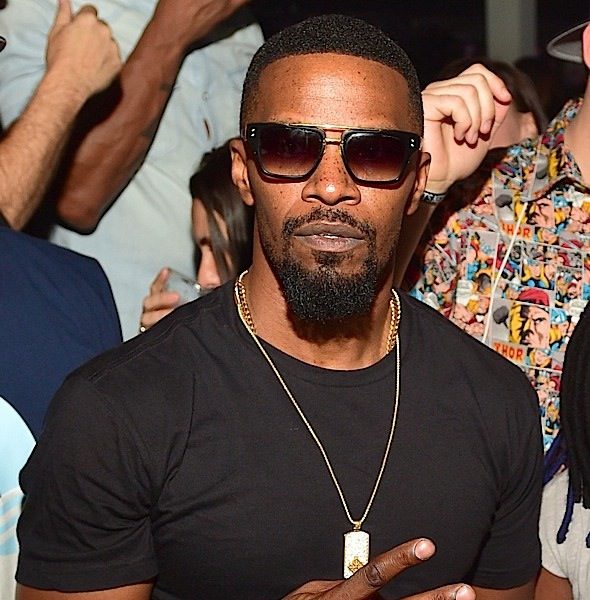

Next Article Jamie Foxx Target of Racial Slur

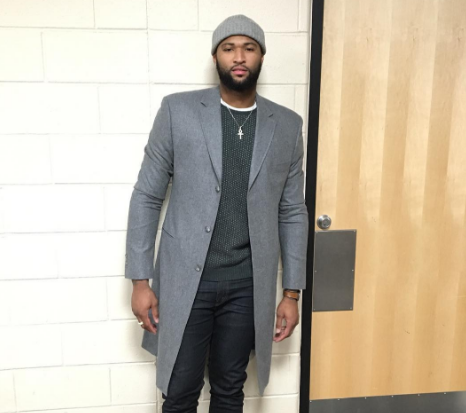

Jamie Foxx Target of Racial Slur  NBA’s DeMarcus Cousins – Under Age Celtics Fan Banned For 2-Years After Calling Him The N-Word

NBA’s DeMarcus Cousins – Under Age Celtics Fan Banned For 2-Years After Calling Him The N-Word ![Beyoncé & Jay Z Go Beachin’: Hawaii Honeymoonin’ [Photos]](https://thejasminebrand.com/wp-content/uploads/2015/04/eyonce-hawaii-bathing-suit-anniversary-the-jasmine-brand.jpg) Beyoncé & Jay Z Go Beachin’: Hawaii Honeymoonin’ [Photos]

Beyoncé & Jay Z Go Beachin’: Hawaii Honeymoonin’ [Photos]  EXCLUSIVE: RHOA’s Porsha Williams Preparing To Announce Pregnancy

EXCLUSIVE: RHOA’s Porsha Williams Preparing To Announce Pregnancy  Another Landlord Tries to Evict Rapper Tyga

Another Landlord Tries to Evict Rapper Tyga  Blac Chyna Accused Of Holding A Woman Hostage In Her Hotel Room During ‘Drug-Fueled Party’

Blac Chyna Accused Of Holding A Woman Hostage In Her Hotel Room During ‘Drug-Fueled Party’  Tiny’s Friend Shares Cryptic Message About Crumbling Marriage To T.I.: You became a felon for him.

Tiny’s Friend Shares Cryptic Message About Crumbling Marriage To T.I.: You became a felon for him.  Vintage News of A Trey Songz’s Stripper Assault Leaked

Vintage News of A Trey Songz’s Stripper Assault Leaked