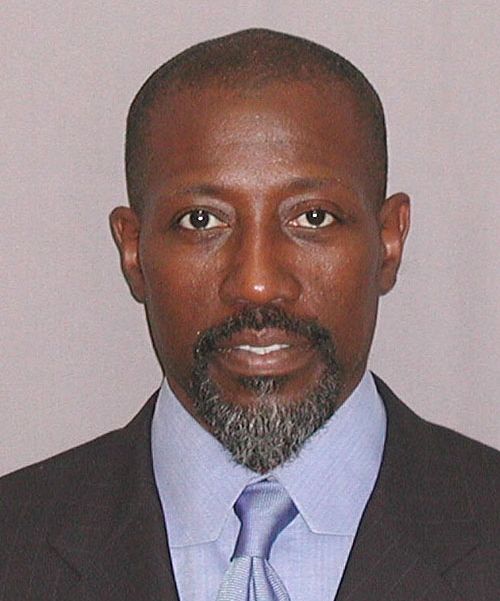

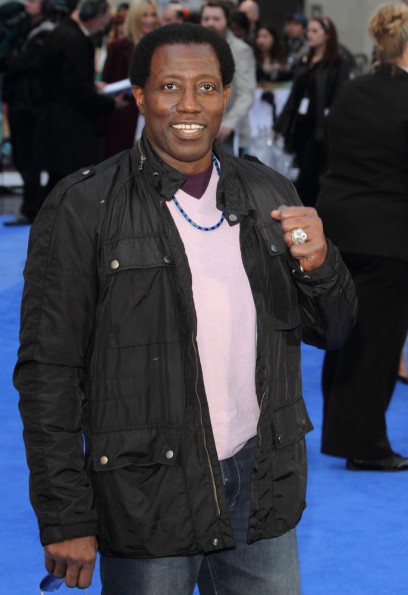

Wesley Snipes Forced To Fork Over At Least $9.5 Million In Back Taxes

Wesley Snipes Forced To Fork Over At Least $9.5 Million In Back Taxes

Aside from his blood sucking character on “Blade,” Wesley Snipes is also known for not paying his taxes on time. According to new reports, Snipes is expected to fork over millions of dollars to the IRS after failing to provide adequate information as to why he can’t provide the assets to pay more than six figures. Upon the IRS attempting to gather $23.5 million in back taxes (from 2001-2006), the actor requested for an offer-in-compromise (OIC) and for the lien on his home to be removed.

The OIC would allow him to settle his debt for less than the amount owed and the actor attempted to pay at least $850,000 in cash for the OIC, but the IRS rejected it, and the lien still remains. Snipes followed up with a petition, requesting the tax court overturn their decision. The reasoning for the tax court to reject his proposal is due to the fact that Snipes has failed to provide proof of assets and his financial condition.

After a settlement officer reviewed his assets and the details of his case, he lowered the actor’s outstanding debt to about $17.5 million, but then to $9.5 million, but Snipes never increased is original OIC.

In the midst of all this, Snipes claims his financial adviser had admitted to misconduct when it came to disposing his assets and taking out loans without his knowledge. He stated he would provide an affidavit, but the tax court never received it. Judge Kathleen Kerrigan gave a statement about the tax courts recent ruling,

Given the disparity between petitioner’s $842,061 OIC and the settlement officer’s calculation of $9,581,027 as his RCP, as well as petitioner’s inability to credibly document his assets, the settlement officer and her manager had ample justification to reject the offer. Accordingly, we conclude that the settlement officer did not abuse her discretion in determining that acceptance of petitioner’s OIC was not in the best interest of the United States.

Previous Article

Previous Article Next Article

Next Article T.I. Defends Chris Brown Amid Rape Allegations

T.I. Defends Chris Brown Amid Rape Allegations  Zoe Kravitz Talks Battle With An Eating Disorder, Relationship With Drake & Desire to Be Non-Famous + Complex Photos

Zoe Kravitz Talks Battle With An Eating Disorder, Relationship With Drake & Desire to Be Non-Famous + Complex Photos ![Tiny’s BFF Shekinah Admits She Was Punched & Attacked By Ex: Nobody deserves to be hit! [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2017/04/Screen-Shot-2017-04-26-at-9.35.44-AM.png) Tiny’s BFF Shekinah Admits She Was Punched & Attacked By Ex: Nobody deserves to be hit! [VIDEO]

Tiny’s BFF Shekinah Admits She Was Punched & Attacked By Ex: Nobody deserves to be hit! [VIDEO]  Chrisette Michele Sued Her Fiance & Hadn’t Spoken To Him In 7 Years Before Their Engagement

Chrisette Michele Sued Her Fiance & Hadn’t Spoken To Him In 7 Years Before Their Engagement  Rihanna Does Dinner in Fashionable Undies + Rosario Dawson Stuns At Cesar Chavez Premiere

Rihanna Does Dinner in Fashionable Undies + Rosario Dawson Stuns At Cesar Chavez Premiere ![Serena Williams Debuts Newborn Daughter [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2017/09/Screen-Shot-2017-09-13-at-10.31.43-AM.png) Serena Williams Debuts Newborn Daughter [VIDEO]

Serena Williams Debuts Newborn Daughter [VIDEO] ![Momma Dee Performs “In That Order” With Rickey Smiley! [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2016/08/Screen-Shot-2016-08-11-at-3.12.44-PM-620x354.png) Momma Dee Performs “In That Order” With Rickey Smiley! [VIDEO]

Momma Dee Performs “In That Order” With Rickey Smiley! [VIDEO] ![Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO]](https://thejasminebrand.com/wp-content/uploads/2016/06/taylor-swift-lil-mo-the-jasmine-brand.jpg) Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO]

Lil Mo Calls Taylor Swift A THOT, Accuses Her of Having STD’s [AUDIO]