Georgia Residents Can Now Claim Fetuses As $3,000 Tax Deduction Following Roe v. Wade Reversal

Georgia Residents Can Now Claim Fetuses As $3,000 Tax Deduction Following Roe v. Wade Reversal

Looks like Georgia is putting their money where its mouth is.

As previously reported, Roe v. Wade was overturned in June of this year. Since then many states, including Georgia, have issued bans on abortions or strict qualifications for someone to terminate their pregnancy.

According to reports, the state of Georgia recently ruled that unborn children with a fetal heartbeat can now be claimed as an income tax exemption.

The Georgia Department of Revenue said that as of July 20, it would recognize “any unborn child with a detectable human heartbeat” as eligible for the state’s individual income tax dependent exemption. This means that expecting parents may claim embryos as dependents after as early as six weeks gestation — allowing them to receive a $3,000 dependent personal exemption for each unborn child.

This tax benefit is a direct result of Roe V Wade and Georgia’s decision to ban abortions after 6 weeks of pregnancy. Georgia citizens may still qualify for an abortion if; a physician determines a medical emergency exists, a physician determines the pregnancy is “medically futile” or if the pregnancy is a result of rape or incest.

Currently, this policy change only applies to the state tax return. Critics are worried about how this may create questions about women who miscarry during their pregnancy. It is also unclear how far the acknowledgment of the embryo may actually go.

Does this tax exemption change your mind about reversing Roe V Wade? Let us know in the comments.

Previous Article

Previous Article Next Article

Next Article Donald Trump Blocked From Posting On Instagram & Facebook For The Rest Of His Presidency, Could Last ‘Indefinitely’

Donald Trump Blocked From Posting On Instagram & Facebook For The Rest Of His Presidency, Could Last ‘Indefinitely’  Donald Trump Reacts To Meghan Markle Criticizing Him In The Past: I Didn’t Know She Was Nasty.

Donald Trump Reacts To Meghan Markle Criticizing Him In The Past: I Didn’t Know She Was Nasty.  Haiti’s President Jovenel Moïse Assassinated During An Attack On His Home

Haiti’s President Jovenel Moïse Assassinated During An Attack On His Home  Bernie Sanders Endorses Joe Biden For President

Bernie Sanders Endorses Joe Biden For President  Rihanna Lashes Out At Trump Over Mass Shootings: You Spelt Terrorism Wrong!

Rihanna Lashes Out At Trump Over Mass Shootings: You Spelt Terrorism Wrong!  Joe Biden Apologizes For His ‘Ain’t Black’ Comments: I Shouldn’t Have Been Such A Wise Guy

Joe Biden Apologizes For His ‘Ain’t Black’ Comments: I Shouldn’t Have Been Such A Wise Guy  VP Kamala Harris Was Reportedly Livid At Anna Wintour For Using The Photo of Her In Converse For Vogue’s Cover, Book Claims She Felt ‘Belittled’

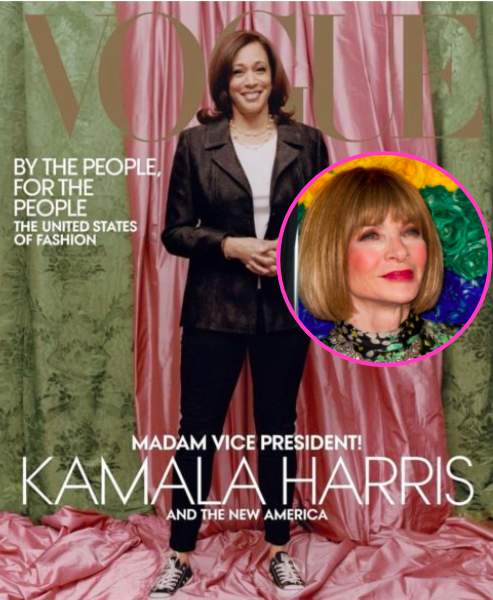

VP Kamala Harris Was Reportedly Livid At Anna Wintour For Using The Photo of Her In Converse For Vogue’s Cover, Book Claims She Felt ‘Belittled’  Donald Trump Says Many Haitian Migrants Coming To US ‘Probably Have AIDS’

Donald Trump Says Many Haitian Migrants Coming To US ‘Probably Have AIDS’