Churches Can Now Endorse Political Candidates Without Losing Tax-Exempt Status, IRS Says In Major Policy Shift

Churches Can Now Endorse Political Candidates Without Losing Tax-Exempt Status, IRS Says In Major Policy Shift

In a landmark shift, the IRS has announced that churches may now endorse political candidates without risking their tax-exempt status, so long as the endorsements occur “in good faith” and within the scope of religious services.

The update came via a court filing Monday, where the agency clarified its interpretation of the Johnson Amendment, a 1954 law that prohibited tax-exempt entities from participating in political campaigns.

The IRS now says that when a house of worship speaks to its congregation “through its customary channels of communication… concerning electoral politics viewed through the lens of religious faith,” it does not constitute campaign intervention. The agency likened such endorsements to a “family discussion,” emphasizing they are protected under the First Amendment.

This shift follows years of pressure from religious organizations and echoes promises made by President Trump to “totally destroy the Johnson Amendment.” While not fully repealed, the IRS’s new stance marks a dramatic reinterpretation.

What are your thoughts on this?

Previous Article

Previous Article Next Article

Next Article Donald Trump Vows To ‘Stop Transgender Lunacy’ w/ Executive Orders

Donald Trump Vows To ‘Stop Transgender Lunacy’ w/ Executive Orders  Rihanna Lashes Out At Trump Over Mass Shootings: You Spelt Terrorism Wrong!

Rihanna Lashes Out At Trump Over Mass Shootings: You Spelt Terrorism Wrong!  Comedian Tony Hinchcliffe Refuses To Apologize For Joke Referring To Puerto Rico As A ‘Floating Island Of Garbage’ During Trump Rally

Comedian Tony Hinchcliffe Refuses To Apologize For Joke Referring To Puerto Rico As A ‘Floating Island Of Garbage’ During Trump Rally  Amber Rose Says Kamala Harris Being Elected Will Be A Sad Depressed Murderous, Broke A$$ 4 Years

Amber Rose Says Kamala Harris Being Elected Will Be A Sad Depressed Murderous, Broke A$$ 4 Years  Amber Rose Faces Backlash After Announcing Republican National Convention Speaking Gig

Amber Rose Faces Backlash After Announcing Republican National Convention Speaking Gig  CBS Scraps ‘60 Minutes’ Trump Deportee Prison Report Hours Before Airing; Insider Says Decision Was “Political, Not Editorial”

CBS Scraps ‘60 Minutes’ Trump Deportee Prison Report Hours Before Airing; Insider Says Decision Was “Political, Not Editorial”  California Governor Gavin Newsom Confronted By Mother After Palisades Fire Destroys Her Daughter’s School

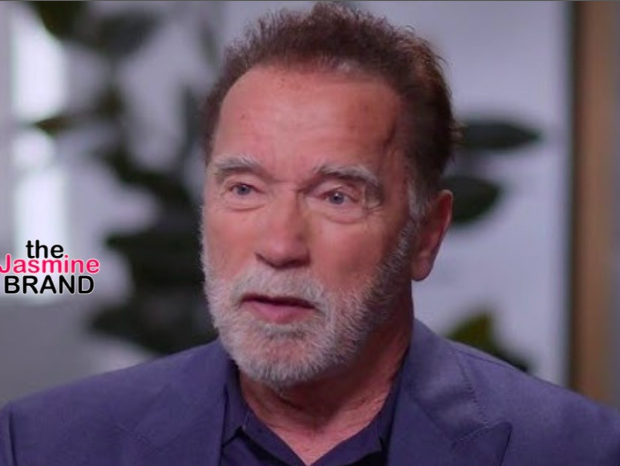

California Governor Gavin Newsom Confronted By Mother After Palisades Fire Destroys Her Daughter’s School  Arnold Schwarzenegger Donated $250,000 To Build 25 Tiny Homes For Homeless Vets

Arnold Schwarzenegger Donated $250,000 To Build 25 Tiny Homes For Homeless Vets