(EXCLUSIVE) Mary J. Blige Drops $160k to Pay Off Massive State Tax Debt, Amidst Reports Ex-Husband Wants $130k Monthly Spousal Support

Mary J. Blige Drops $160k to Pay Off Massive State Tax Debt

theJasmineBRAND.com exclusively reports, Mary J. Blige has coughed up $166,000+ to settle her massive tax debt to the State of New Jersey — the same month her estranged husband pleaded in court for the judge to award him over $130k a month in spousal support to maintain the luxury life he had with the singer.

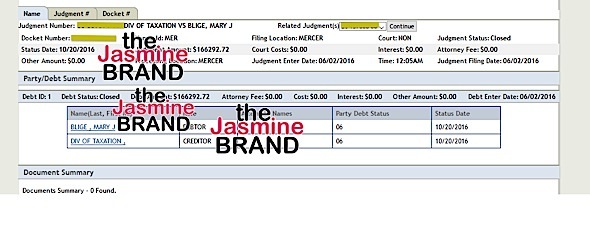

Back in June, The New Jersey Division of Taxation filed a tax lien against the singer accusing her of screwing them out of $166,292.72 in unpaid state taxes. The year in which they accuse Blige of owing is unclear based on the records.

Then on October 20th, the Division of Taxation released the lien against the singer due to her paying the full $166k to cover the unpaid tax bill.

Blige filed for divorce from her husband of 12-years, Martin ‘Kendu’ Issacs, back in September. She demanded her soon-to-be ex not be awarded a dime in spousal support. Kendu filed docs in their divorce pleading with the judge to order Mary to pay him a total of $129,319 per month.

He explained when he was working as Mary’s personal manager he brought in $46,205 a month. However, since firing him, he currently has no source of income, despite making $554,465 last year as manager.

The docs stated that during their marriage, their luxurious lifestyle included traveling on private planes, dining at expensive restaurants and socializing with A-List stars. He believes the singer should pay him the support, so he can maintain the type of life he had with her. The judge has yet to make a ruling on the matter.

Over the last few years, Blige has suffered numerous financial issues with lawsuits over unpaid million dollar loans, having to pay $932k to pay off back state taxes and still on the hook for $3.4 million dollars in back taxes to the IRS for 2009 ($574,907.30), 2010 ($2,203,743.53) and 2011 ($647,604.60). The singer’s rep at the time said,

Mary has been and is continuing to work with her new team to resolve all these issues as quickly as possible.

Follow us: @theJasmineBRAND on Twitter | theJasmineBRAND on Facebook| theJasmineBRAND_ on Instagram

Previous Article

Previous Article Next Article

Next Article![[WATCH] August Alsina Credits Facial Tattoos & Brother’s Death For Motivation](https://thejasminebrand.com/wp-content/uploads/2014/04/Screen-shot-2014-04-02-at-9.03.19-AM-620x470.png) [WATCH] August Alsina Credits Facial Tattoos & Brother’s Death For Motivation

[WATCH] August Alsina Credits Facial Tattoos & Brother’s Death For Motivation  Rita Ora Releases “Body On Me” Video Feat. Chris Brown

Rita Ora Releases “Body On Me” Video Feat. Chris Brown  Dominican Republic Nightclub Roof Collapse Leaves At Least 27 De@d, Over 150 Injured

Dominican Republic Nightclub Roof Collapse Leaves At Least 27 De@d, Over 150 Injured ![[New Music] Lil Kim Releases ‘Identity Theft’, Nicki Minaj Diss](https://thejasminebrand.com/wp-content/uploads/2014/08/lil-kim-nicki-minaj-diss-identity-theft-the-jasmine-brand.jpg) [New Music] Lil Kim Releases ‘Identity Theft’, Nicki Minaj Diss

[New Music] Lil Kim Releases ‘Identity Theft’, Nicki Minaj Diss ![Angela Simmons’ Baby Daddy Faced A Drug Trafficking Charge [Thug Life]](https://thejasminebrand.com/wp-content/uploads/2016/12/angela-simmons-fiance-sutton.jpg) Angela Simmons’ Baby Daddy Faced A Drug Trafficking Charge [Thug Life]

Angela Simmons’ Baby Daddy Faced A Drug Trafficking Charge [Thug Life]  LaVar Ball Wants To Start League For Players Who Skip College, Junior Basketball Association

LaVar Ball Wants To Start League For Players Who Skip College, Junior Basketball Association  Evan Ross & Ashlee Simpson Announce Engagement

Evan Ross & Ashlee Simpson Announce Engagement ![DeVon Franklin Checks Church Member Who Tells Meagan Good to Stop Dressing Sexy [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2016/02/Screen-Shot-2016-02-16-at-10.26.57-AM.png) DeVon Franklin Checks Church Member Who Tells Meagan Good to Stop Dressing Sexy [VIDEO]

DeVon Franklin Checks Church Member Who Tells Meagan Good to Stop Dressing Sexy [VIDEO]