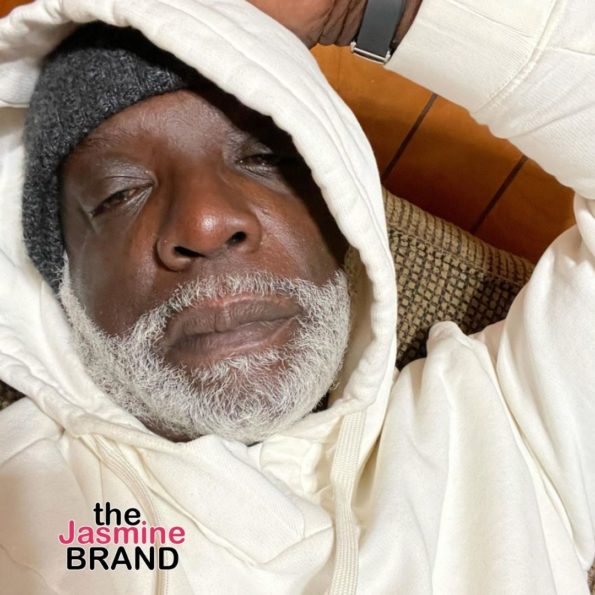

Peter Thomas Admits To Not Paying His Business Taxes: ‘I Have To Be Accountable’

Peter Thomas

Peter Thomas Admits To Not Paying His Business Taxes: ‘I Have To Be Accountable’

Update (June 25, 2024): Peter Thomas is ready to right his wrongs.

The Real Housewives of Atlanta alum, 63, has finally admitted to not paying his business taxes.

In a video posted on social media yesterday (Monday, June 24), Peter Thomas first apologized to his mother, his late father, and his family and friends. He added,

“I’ve did some wrong that I have to make right. I have to stand up, I have to be accountable, I have to be responsible and I have to pay my debt.”

He referenced the IRS’ case against him, which began in early 2022, and said his tax owings go back about a decade.

“From one struggling business to the next … I failed to pay my withholding taxes on time. And at some point, when the business wasn’t doing well, failed to pay at all. It’s something that I thought I could work out, catch up with, make whole. But then the hole got deeper for me.”

Peter Thomas, who was also recently hit with a $9 million judgment for unpaid rent for his Miami restaurant, continued,

“I deeply regret, deeply, and I’m saying this with all sincerity, I deeply regret [not making] the IRS withholding taxes a priority in my life. With no excuses because there is none. It’s the law. And I’m finding out a lot about that law lately.”

He sent a warning to business owners and told them to be sure they have enough money to pay their employees after taking care of other financial company responsibilities like utilities and rent. He added,

“Make sure you can cover those withholding taxes. Make sure on the 20th of every month you pay those revenue taxes. When those things add up, Uncle Sam is your partner. They’re not getting their piece, it keeps on adding up, it’s gonna come and it’s gonna bite you.”

View this post on Instagram

Original Story (Jan. 7, 2022): Peter Thomas is in hot water with the IRS–again.

Former Real Housewives of Atlanta star Cynthia Bailey’s ex-husband, Peter Thomas, allegedly owes back taxes from over a decade ago. According to Radar Online, the entrepreneur owes $450k in back taxes for an Atlanta restaurant that shut down in 2010.

The restaurant was called Uptown Restaurant & Lounge and, while it was running, Peter allegedly failed to make a total of 10 payments.

Apparently, the missed payments were able to fly under the IRS’ radar–until now.

When the eatery officially closed its doors, Peter blamed The Great Recession, which began in 2007 and ended in 2009. Peter is being accused of not paying his taxes from December 2008 to December 2009.

The ex-reality star could lose his assets if he doesn’t pay his debts off promptly. As of this report, he still hasn’t covered the $450,399.52 bill that he owes.

Since his past restaurant failures, Peter has opened Bar One in Miami, which appears to be doing well.

Peter has a history of financial troubles, especially in terms of owning restaurants. In 2019, theJasmineBRAND exclusively reported that he was forced to close his Charlotte bar over a tax lien. He racked up more than $200,000 in unpaid taxes. The sports bar–called Sports One Charlotte–was said to return without Peter. According to a source, the bar fell off the map due to Peter’s inability to juggle his finances for multiple projects. At the time, Peter was working on Bar One.

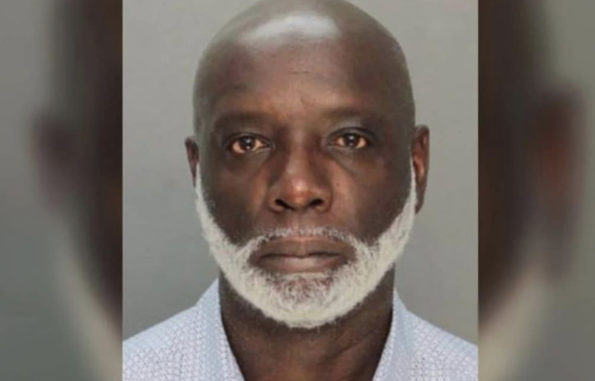

That same year, he was arrested for allegedly writing fake checks. He was released after 6 days and denied the claims.

Peter Thomas Mugshot

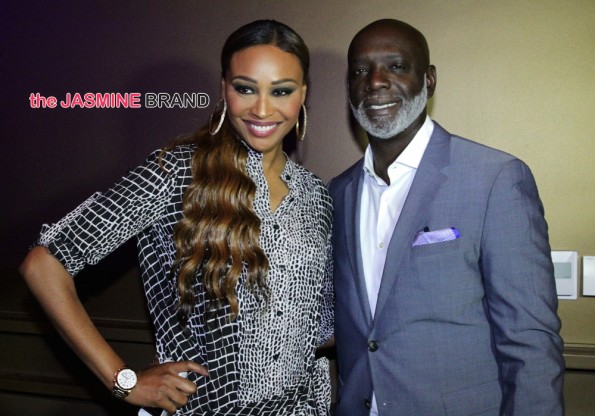

His ex-wife, Cynthia Bailey, sued him for an unpaid loan in 2020. They have since made a private settlement.

Cynthia & Peter in 2014

Cynthia and Peter wed in 2010, the same year they began starring in The Real Housewives of Atlanta. They divorced in 2017.

Peter hasn’t directly addressed the accusations.

Do you think Peter should give up on restaurants for good? Leave us a comment and let us know!

Previous Article

Previous Article Next Article

Next Article![[EXCLUSIVE] Zeus President & CEO Lemuel Plummer Responds To Joseline’s Cabaret Lawsuit & ‘Bad Boys: Los Angeles’ Castmate Andrew Caldwell’s Sexual Harassment Allegations: No Claims Have Been Filed Regarding Anything](https://thejasminebrand.com/wp-content/uploads/2022/04/Kodak-Black-8-620x600.png) [EXCLUSIVE] Zeus President & CEO Lemuel Plummer Responds To Joseline’s Cabaret Lawsuit & ‘Bad Boys: Los Angeles’ Castmate Andrew Caldwell’s Sexual Harassment Allegations: No Claims Have Been Filed Regarding Anything

[EXCLUSIVE] Zeus President & CEO Lemuel Plummer Responds To Joseline’s Cabaret Lawsuit & ‘Bad Boys: Los Angeles’ Castmate Andrew Caldwell’s Sexual Harassment Allegations: No Claims Have Been Filed Regarding Anything  ‘Little Women: Atlanta’ Star Ms. Juicy Returns To Social Media For First Time Since Suffering From A Stroke: I Couldn’t Remember Anything, I Can’t Even Drive Right Now Or Brush My Teeth

‘Little Women: Atlanta’ Star Ms. Juicy Returns To Social Media For First Time Since Suffering From A Stroke: I Couldn’t Remember Anything, I Can’t Even Drive Right Now Or Brush My Teeth  Real Housewives Of Dubai’s Chanel Ayan Says At The Age of 5 She Underwent Forced Genital Mutilation, A Painful Practice Performed To Retain Virginity Until Marriage

Real Housewives Of Dubai’s Chanel Ayan Says At The Age of 5 She Underwent Forced Genital Mutilation, A Painful Practice Performed To Retain Virginity Until Marriage  Porsha Williams Honors Late Cousin Londie Favors w/ Emotional Birthday Tribute

Porsha Williams Honors Late Cousin Londie Favors w/ Emotional Birthday Tribute  Brit Eady Officially Announces Her Departure From ‘RHOA’ + Says So No Longer Served Her: ‘I Choose Peace’

Brit Eady Officially Announces Her Departure From ‘RHOA’ + Says So No Longer Served Her: ‘I Choose Peace’ ![Love & Hip Hop New York’s Mendeecees Harris Posts New Pictures From Prison [PHOTOS]](https://thejasminebrand.com/wp-content/uploads/2019/11/Mendeecees-Harris-shares-photos-from-jail-thejasminebrand.png) Love & Hip Hop New York’s Mendeecees Harris Posts New Pictures From Prison [PHOTOS]

Love & Hip Hop New York’s Mendeecees Harris Posts New Pictures From Prison [PHOTOS]  Kendall Jenner Admits Feeling The LEAST Sexy Of Her Sisters: “Am I Supposed To Be Sexy Like Them?”

Kendall Jenner Admits Feeling The LEAST Sexy Of Her Sisters: “Am I Supposed To Be Sexy Like Them?”  ‘Cheer’ Star Jerry Harris Ordered To Pay $136,000 To Minor Victims Amid 12-Year Prison Sentence For Child Pornography Charges

‘Cheer’ Star Jerry Harris Ordered To Pay $136,000 To Minor Victims Amid 12-Year Prison Sentence For Child Pornography Charges