Churches Can Now Endorse Political Candidates Without Losing Tax-Exempt Status, IRS Says In Major Policy Shift

Churches Can Now Endorse Political Candidates Without Losing Tax-Exempt Status, IRS Says In Major Policy Shift

In a landmark shift, the IRS has announced that churches may now endorse political candidates without risking their tax-exempt status, so long as the endorsements occur “in good faith” and within the scope of religious services.

The update came via a court filing Monday, where the agency clarified its interpretation of the Johnson Amendment, a 1954 law that prohibited tax-exempt entities from participating in political campaigns.

The IRS now says that when a house of worship speaks to its congregation “through its customary channels of communication… concerning electoral politics viewed through the lens of religious faith,” it does not constitute campaign intervention. The agency likened such endorsements to a “family discussion,” emphasizing they are protected under the First Amendment.

This shift follows years of pressure from religious organizations and echoes promises made by President Trump to “totally destroy the Johnson Amendment.” While not fully repealed, the IRS’s new stance marks a dramatic reinterpretation.

What are your thoughts on this?

Previous Article

Previous Article Next Article

Next Article Caitlyn Jenner Says She Is Against Transgender Girls Competing In Girls Sports

Caitlyn Jenner Says She Is Against Transgender Girls Competing In Girls Sports  Donald Trump Sues Twitter To Get His Account Back, Says Ban Violates His 1st Amendment Rights

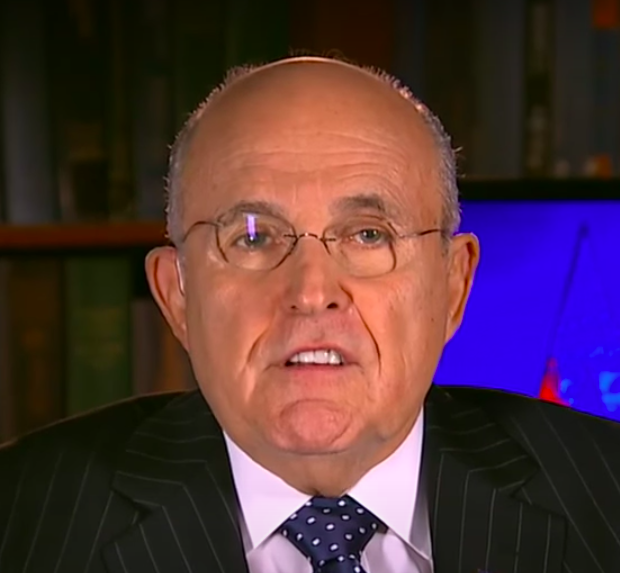

Donald Trump Sues Twitter To Get His Account Back, Says Ban Violates His 1st Amendment Rights  Rudy Giuliani Claims ‘I Have No Cash’ After Hearing In Ongoing $148 Million Defamation Case

Rudy Giuliani Claims ‘I Have No Cash’ After Hearing In Ongoing $148 Million Defamation Case  President & First Lady to Host a Juneteenth Concert at The White House on Tuesday, June 13, 2023 Featuring: Method Man, Jennifer Hudson, Ledisi & More

President & First Lady to Host a Juneteenth Concert at The White House on Tuesday, June 13, 2023 Featuring: Method Man, Jennifer Hudson, Ledisi & More  Rudy Giuliani, Donald Trump’s Former Attorney, Disbarred Over ‘False & Misleading’ Statements On 2020 Election

Rudy Giuliani, Donald Trump’s Former Attorney, Disbarred Over ‘False & Misleading’ Statements On 2020 Election  D.C. Mayor Muriel Bowser Has Plan In Case ‘District Has To Defend Itself’ As Trump Plans Concerning Changes

D.C. Mayor Muriel Bowser Has Plan In Case ‘District Has To Defend Itself’ As Trump Plans Concerning Changes  Michelle Obama & Kerry Washington Ask People NOT To Purchase WIC Products

Michelle Obama & Kerry Washington Ask People NOT To Purchase WIC Products  Rachel Dolezal, Former NAACP Leader Who Posed As A Black Woman, Celebrates 48th Birthday

Rachel Dolezal, Former NAACP Leader Who Posed As A Black Woman, Celebrates 48th Birthday