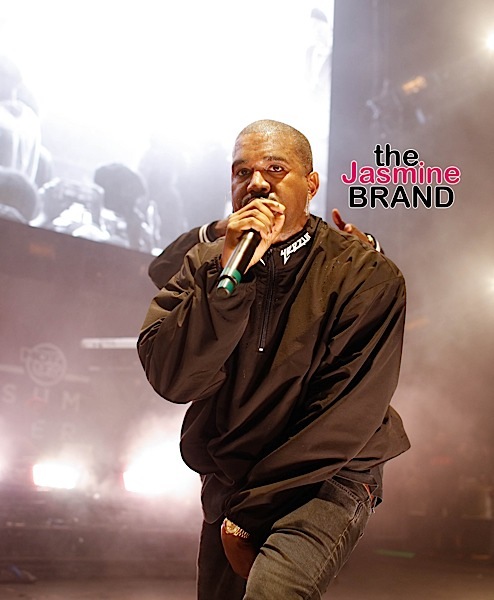

Kanye West – Insurance Company Responds To Rapper’s $10 Million Lawsuit

Kanye West – Insurance Co Responds To Rapper’s Lawsuit

The lawsuit between Kanye West and his insurance company continues. A Lloyd’s of London syndicate has responded to the rapper’s $10 million lawsuit, with counterclaims that point to insurance policy exclusions pertaining to a pre-existing psychological condition, possession of illegal drugs, prescription drugs not taken as medically prescribed, and the consumption of alcohol rendering the insured unfit to perform.

As previously reported, earlier this month Kanye filed a lawsuit and in his touring company’s complaint, the rapper’s cooperation with insurers to demands for information was highlighted. For instance, West submitted himself to an interrogation under oath after checking himself into the UCLA Neuropsychiatric Hospital Center and canceling the second leg of his “Saint Pablo Tour.” The goal was to convince the insurers that West’s mental breakdown was real, unexpected, and not due to pernicious influences.

In counterclaims, the insurers present a different story, stating in court docs,

Underwriters’ investigation indicates substantial irregularities in Mr. West’s medical history. Furthermore the insured’s failure to cooperate in Underwriters’ investigation is contrary to the duties of cooperation VGT agreed to as a condition precedent to any obligation of Underwriters to pay any claim arising under the Policies. Throughout Underwriters’ investigation, VGT and its legal, medical and other agents and representatives have delayed, hindered, stalled and or refused to provide information both relevant and necessary for Underwriters to complete their investigation of the claim.

The defendants are seeking declaratory relief that they have no duty to indemnify West’s company because the insuring clause allegedly has not been triggered and is expressly excluded by conditions in the policy.

Follow us: @theJasmineBRAND on Twitter | theJasmineBRAND on Facebook| theJasmineBRAND_ on Instagram

![J.Cole Criticizes Kanye West & Wale In 'False Prophets' [VIDEO]](https://thejasminebrand.com/wp-content/uploads/2015/07/Kanye-West-LAX-i-the-jasmine-brand.jpg)

Previous Article

Previous Article Next Article

Next Article![[INTERVIEW] Gary Owen Doesn’t Feel Snubbed By Essence Magazine + Why He Considers Hollywood A ‘Big Temp Job’](https://thejasminebrand.com/wp-content/uploads/2014/06/GaryOwen-Interview-thejasmineBRAND.jpg) [INTERVIEW] Gary Owen Doesn’t Feel Snubbed By Essence Magazine + Why He Considers Hollywood A ‘Big Temp Job’

[INTERVIEW] Gary Owen Doesn’t Feel Snubbed By Essence Magazine + Why He Considers Hollywood A ‘Big Temp Job’ ![Golden Globes After Party: Tracee Ellis Ross, Cuba Gooding Jr, Niecy Nash, Gabrielle Dennis, Marlon Wayans, Kenya Moore [Photos]](https://thejasminebrand.com/wp-content/uploads/2017/01/Screen-Shot-2017-01-09-at-5.39.03-PM.jpg) Golden Globes After Party: Tracee Ellis Ross, Cuba Gooding Jr, Niecy Nash, Gabrielle Dennis, Marlon Wayans, Kenya Moore [Photos]

Golden Globes After Party: Tracee Ellis Ross, Cuba Gooding Jr, Niecy Nash, Gabrielle Dennis, Marlon Wayans, Kenya Moore [Photos]  DeRay Mckesson Released From Jail: ’50 of us were in 1 cell, sleeping on the floor.’

DeRay Mckesson Released From Jail: ’50 of us were in 1 cell, sleeping on the floor.’  Mary Mary: Erica and Tina Campbell’s Father Dies Of Cancer

Mary Mary: Erica and Tina Campbell’s Father Dies Of Cancer  Jay-Z & Beyonce Host Oscars Bash: DJ Khaled, Lisa Bonet, Shonda Rhimes, Angela Bassett, Dave Chappelle Attend

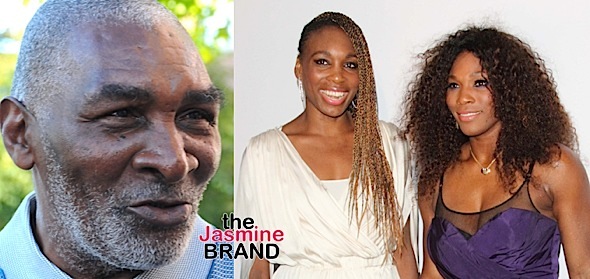

Jay-Z & Beyonce Host Oscars Bash: DJ Khaled, Lisa Bonet, Shonda Rhimes, Angela Bassett, Dave Chappelle Attend  Serena & Venus Williams Father Suffers Stroke, Memory Loss

Serena & Venus Williams Father Suffers Stroke, Memory Loss  Karrueche Finally Breaks Her Silence On Chris Brown, ‘Things Could Be Much Worse’

Karrueche Finally Breaks Her Silence On Chris Brown, ‘Things Could Be Much Worse’  Lil Tay’s Mother Defends Daughter’s Behavior: It’s Just Entertainment, She’s Well-Behaved

Lil Tay’s Mother Defends Daughter’s Behavior: It’s Just Entertainment, She’s Well-Behaved