IRS Admits Black Taxpayers Are Five Times More Likely To Be Audited Than Any Other Race

IRS Admits Black Taxpayers Are Five Times More Likely To Be Audited Than Any Other Race

The Internal Revenue Service (IRS) has discovered that Black taxpayers are audited at higher rates than any other race.

The findings come after researchers found that Black Americans are up to five times more likely to have their federal tax returns audited than taxpayers of other races.

The internal investigation was brought on after lawmakers and policy experts called on the IRS to review its auditing processes following the findings about Black taxpayers.

IRS Commissioner Daniel Werfel wrote a letter to the U.S. Senate:

“[O]ur initial findings support the conclusion that Black taxpayers may be audited at higher rates than would be expected given their share of the population.”

Werfel noted that the IRS plans to use an $80 billion fund through the Inflation Reduction Act to

“understand any potential systemic bias in compliance strategies and treatments.”

The agency said it will evaluate its processes to determine the source of racial disparities, and consider changing how it chooses which tax returns to audit.

Some lawmakers called for change following Werfel’s discovery. Rep. Bill Pascrell, Jr. tweeted,

“Back in March my colleagues and I raised alarms to the new IRS boss about Black taxpayers being over-audited and today he confirmed our suspicions. The IRS is making strides but extra audits of Black Americans is disgraceful and must end.”

According to the study done earlier this year, the higher audit rate for Black taxpayers is because of a flawed artificial intelligence algorithm used by the tax agency.

Werfel noted in the letter,

“We will work to identify any disparities across dimensions including age, gender, geography, race, and ethnicity as well as continually refining our approaches to compliance and enforcement to improve fairness in tax administration and maintain accountability to taxpayers as informed by our research.”

What are your thoughts? Let us know in the comments below!

Previous Article

Previous Article Next Article

Next Article Keshia Knight Pulliam Says Baby Daddy Ed Hartwell Late On Child Support

Keshia Knight Pulliam Says Baby Daddy Ed Hartwell Late On Child Support  Meek Mill Sentenced To 2-4 Years In State Prison

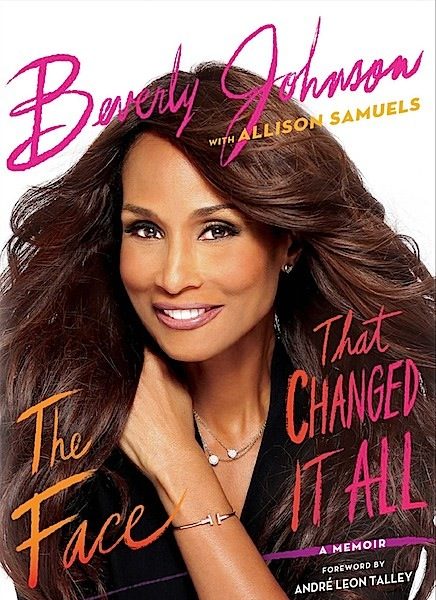

Meek Mill Sentenced To 2-4 Years In State Prison  Beverly Johnson’s Diet Once Consisted of Cocaine, Champagne & Coffee: The skinnier you were, the more fabulous you were.

Beverly Johnson’s Diet Once Consisted of Cocaine, Champagne & Coffee: The skinnier you were, the more fabulous you were. ![Nicki Minaj Takes Top Off For the ‘Gram [Stop & Stare]](https://thejasminebrand.com/wp-content/uploads/2017/12/Screen-Shot-2017-12-15-at-2.06.50-PM.png) Nicki Minaj Takes Top Off For the ‘Gram [Stop & Stare]

Nicki Minaj Takes Top Off For the ‘Gram [Stop & Stare]  (EXCLUSIVE) Young Dro Stuck In Jail Over Violating Court Order

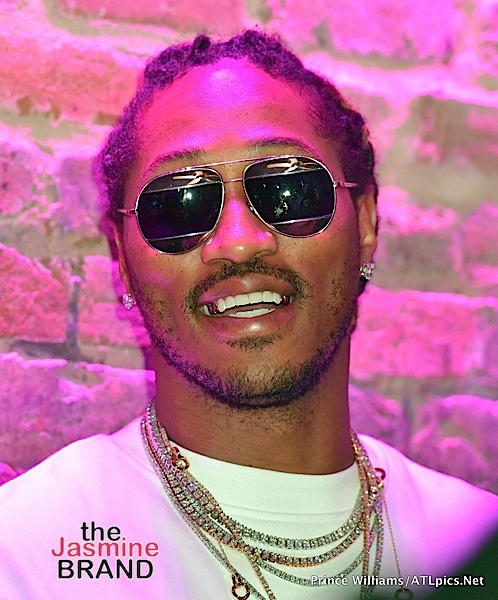

(EXCLUSIVE) Young Dro Stuck In Jail Over Violating Court Order  Future: I Can’t Wife A THOT!

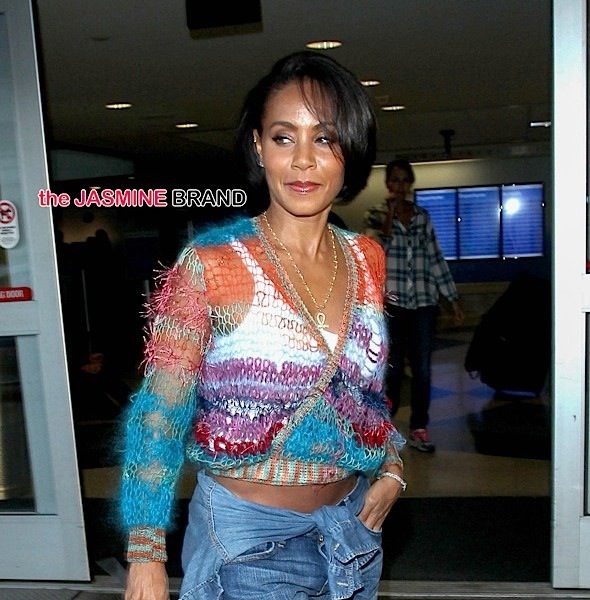

Future: I Can’t Wife A THOT!  Jada Pinkett-Smith: I’m Not A Scientologist

Jada Pinkett-Smith: I’m Not A Scientologist ![Jaden Smith, Kylie Jenner, Kendall Jenner, Cara Delevingne Attend ‘Paper Towns’ Premiere [Photos]](https://thejasminebrand.com/wp-content/uploads/2015/07/Jaden-Smith-Kylie-Jenner-Kendall-Jenner-Paper-Towns-Premiere-the-jasmine-brand.jpg) Jaden Smith, Kylie Jenner, Kendall Jenner, Cara Delevingne Attend ‘Paper Towns’ Premiere [Photos]

Jaden Smith, Kylie Jenner, Kendall Jenner, Cara Delevingne Attend ‘Paper Towns’ Premiere [Photos]