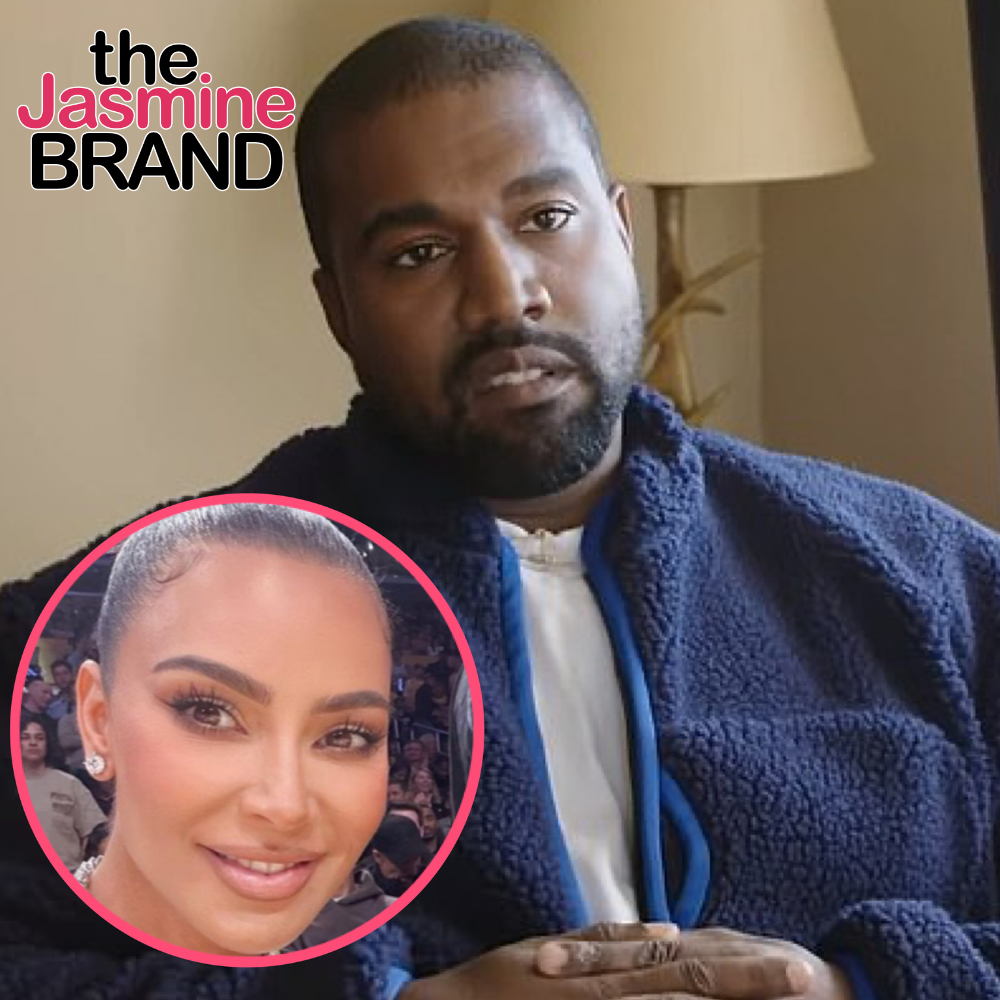

Kanye West Reportedly Dodging Nearly $1 Million In Unpaid Taxes For His Yeezy Brand & Previous Homes w/ Ex-Wife Kim Kardashian

Kanye West Reportedly Dodging Nearly $1 Million In Unpaid Taxes For His Yeezy Brand & Previous Homes w/ Ex-Wife Kim Kardashian

It looks like Kanye West owes the IRS some major coins!

According to reports, rapper/fashion designer Kanye West has fallen into a hole of unresolved tax issues.

Kanye West

Allegedly, Kanye West’s controversial apparel brand, Yeezy, is facing four active tax liens at the moment. The two California residences he shared with his former wife, Kim Kardashian, aren’t sitting too pretty with the IRS either.

Reportedly, West was slapped with the first claim for Yeezy in July 2021. Filings in February 2022 and September 2022 followed. The most recent one is said to have been in March 2023. The whopping amount allegedly owed comes up to $934,033.56.

Additionally, the property taxes that the 46-year-old failed to pay were for a four-bedroom mansion ($2 million) and a three-bedroom apartment ($1.6 million), which are both located in Calabasas.

He and Kardashian purchased the pads between 2017-2018. However, both were given to West in their divorce proceedings.

Kim Kardashian, Kanye West

The combined total of lapsed taxes that West is being held accountable for is $101,093, reports claim.

No word on if or when the ‘Donda’ lyricist will get it paid off.

Along with losing numerous big-brand deals due to his antisemitic rants, West is now swimming in legal matters, including a lawsuit from former remodeler Tony Saxon.

Saxon accused the wealthy musician of labor violations due to forcing him to work under hazardous conditions when helping West reconstruct his Malibu home.

Kanye West

He said in an interview,

“You can only pay people so much to do crazy work.”

Saxon alleged that he was forced to work 16-hour days on the project and subjected to an unfair job environment.

Hopefully, West’s new bride, Bianca Censori, is in it for the long haul. He’s going to need someone by his side for this messy ride.

What are your thoughts? Let us know in the comments below!

Previous Article

Previous Article Next Article

Next Article Frank Ocean Is Reportedly Shopping A Brand New Album To Various Record Labels

Frank Ocean Is Reportedly Shopping A Brand New Album To Various Record Labels  Monica Says She Had “Multiple Blood Transfusions” While Discussing Her Recent Surgery For Endometriosis

Monica Says She Had “Multiple Blood Transfusions” While Discussing Her Recent Surgery For Endometriosis  JT & Yung Miami Address Delay In Their Upcoming Album: It’s Not Dropping Cause We Had Some Issues

JT & Yung Miami Address Delay In Their Upcoming Album: It’s Not Dropping Cause We Had Some Issues  NBA YoungBoy Sentenced To 27 Months In Jail Amid Federal Gun Case, Lawyer Says He Could Be Released In A Year Thanks To Time Served

NBA YoungBoy Sentenced To 27 Months In Jail Amid Federal Gun Case, Lawyer Says He Could Be Released In A Year Thanks To Time Served  Bow Wow – Mother Of His Son Posts Cryptic Message: I Salute The Real Fathers Who Actually Spend Time With Their Child

Bow Wow – Mother Of His Son Posts Cryptic Message: I Salute The Real Fathers Who Actually Spend Time With Their Child  Drake Says He Has An ‘Emotional Budget I Can’t Go Over’ Amid Feud With Kanye West

Drake Says He Has An ‘Emotional Budget I Can’t Go Over’ Amid Feud With Kanye West  Cardi B Defends Daughter After Critics Call Her Swimsuit Pics “Too Grown”: She’s A Very Sweet, Innocent Girl

Cardi B Defends Daughter After Critics Call Her Swimsuit Pics “Too Grown”: She’s A Very Sweet, Innocent Girl  Nicki Minaj’s Husband Kenneth Petty Agrees To Plea Deal For Neglecting To Register As A Sex Offender In California

Nicki Minaj’s Husband Kenneth Petty Agrees To Plea Deal For Neglecting To Register As A Sex Offender In California