Wendy Williams Obtains Power Of Attorney In Hopes Of Gaining Back Access To Frozen Bank Accounts, Says She’s At Risk of Defaulting Mortgage & Employee Payroll

Wendy Williams Obtains Power Of Attorney In Hopes Of Gaining Back Access To Banking Accounts Frozen By Wells Fargo

Wendy Williams is fighting back after allegedly having her assets frozen.

As previously reported, news broke earlier this month that Wendy Williams, 57, banking accounts had been frozen against her well. The accounts, which reportedly contain millions of dollars, were locked by Wells Fargo about two weeks ago. Reportedly, the bank locked her accounts due to suspicion that the talk show host is suffering from

“financial exploitation, dementia or undue influence.”

According to court documents obtained by theJasmineBRAND, in response to not having access to her accounts, Wendy Williams filed a lawsuit against Wells Fargo and is arguing that their decision to freeze her accounts has caused her,

“imminent and irreparable financial damage.”

According to new reports, in addition to her suit, Williams seems to be complying with requests from the bank in hopes of having her assets unfrozen. The media personality and her legal team claim that Wells Fargo informed them that they would be given a ruling on what will happen with her accounts after Williams provided them with a,

“properly executed, witnessed, and notarized Power of Attorney and signed letter of representation.”

It’s unclear who exactly Williams has selected to act as her power of attorney or what authority level they have. However, according to reports, Wells Fargo still hasn’t told Williams their decision regarding her accounts but instead has brought in their own legal team to handle the dispute.

In her court filings, Williams also revealed how she tried to handle the financial issue outside of court. She wrote,

“I have submitted multiple written requests to Wells Fargo and I have visited various Wells Fargo branches in the South Florida area in an effort to resolve this matter outside of the courtroom.

She added,

“I have defaulted and I am at risk of defaulting on several billing and financial obligations, including, but not limited to, mortgage payments and employee payroll.”

The Wendy Williams Show

What are your thoughts on this entire situation? Tell us below!

Previous Article

Previous Article Next Article

Next Article Stephen ’tWitch’ Boss’ Family To Seek Legal Counsel Following Drug Claims Made In Allison Holker’s Memoir

Stephen ’tWitch’ Boss’ Family To Seek Legal Counsel Following Drug Claims Made In Allison Holker’s Memoir  Radio Personality Miss Jones Shares Update On Wendy Williams, Claims TV Host’s Family ‘Moved Her Down To Florida’ To Recover From Ongoing Health Issues

Radio Personality Miss Jones Shares Update On Wendy Williams, Claims TV Host’s Family ‘Moved Her Down To Florida’ To Recover From Ongoing Health Issues  Roseanne Barr Says She’s Queer As 2 Motherf**kers, Wants People To Stop Using F-Word: Especially When It’s 1 Gay Calling Another Gay That!

Roseanne Barr Says She’s Queer As 2 Motherf**kers, Wants People To Stop Using F-Word: Especially When It’s 1 Gay Calling Another Gay That!  Nick Cannon Admits Not Spending Enough Time With His Kids: I’m Spread Thin

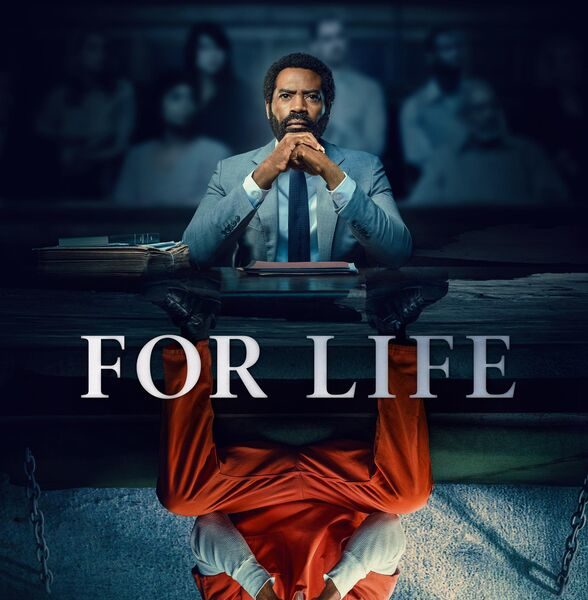

Nick Cannon Admits Not Spending Enough Time With His Kids: I’m Spread Thin  “For Life” Canceled After Two Seasons, 50 Cent Reacts

“For Life” Canceled After Two Seasons, 50 Cent Reacts  ‘Blue Clues’ Star Steve Burns Reflects On Struggling w/ Depression & Death Rumors After Leaving The Show: ‘People You’ve Never Met Tell You That You’re Dead’

‘Blue Clues’ Star Steve Burns Reflects On Struggling w/ Depression & Death Rumors After Leaving The Show: ‘People You’ve Never Met Tell You That You’re Dead’  ‘9’-1-1′ Actress Aisha Hinds Is Livid About Her Run-In With The Police: They Cited Me For Holding My Phone For .3 Seconds!

‘9’-1-1′ Actress Aisha Hinds Is Livid About Her Run-In With The Police: They Cited Me For Holding My Phone For .3 Seconds!  ‘The View” Producers Struggle To Find A Republican Host After Meghan McCain’s Departure

‘The View” Producers Struggle To Find A Republican Host After Meghan McCain’s Departure